Chicago homebuyer tips start with one truth: saving for a home doesn’t mean putting your entire life on pause.

You still want to celebrate your friends’ milestones, take the occasional trip, and enjoy your weekends. But without a plan, those “one-off” expenses can quietly chip away at your down payment fund.

Take wedding season as an example: between travel, gifts, outfits, and pre-wedding festivities, attending just one wedding can cost about $2,000. That’s pretty close to the average monthly rent in the Chicago area, which now hovers around $2,100. When you stack two or three weddings in a summer—and then add in birthdays, holiday spending, and spur-of-the-moment events—it’s no wonder saving feels out of reach.

The truth is, you don’t need to skip every invitation or give up your favorite latte. What you need is a system that lets you spend with intention, save consistently, and keep homeownership in Chicagoland within reach.

We’re living in a time of high rent, rising home prices, and inflation that makes groceries, gas, and nights out more expensive than ever. Without a plan, it’s easy to:

Dip into savings for “just one” event

Let subscriptions and small charges pile up

Delay saving because the goal feels too big

And renters across Chicagoland are feeling that strain. A recent survey found that:

45% made a housing sacrifice to afford wedding celebrations

15% opted for a smaller rental or starter home, and 11% chose to live with roommates

25% turned down at least one event because the cost was too high

The good news? A few intentional shifts can make saving for your first home here feel possible again.

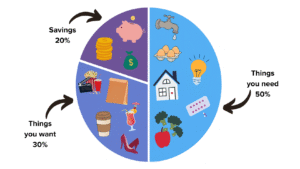

Use the 50/30/20 rule: 50% for needs (like rent), 30% for wants (like celebrations), and 20% for savings or debt payoff.

Treat your down payment savings like rent—non-negotiable. Automate transfers into a separate account every payday.

Even starting with a few hundred dollars helps. Round-up savings apps and high-yield savings accounts can give you a cushion for the unexpected.

In Chicago, many landlords offer concessions like free parking or a month’s free rent at renewal. Ask about incentives or negotiate utilities, internet, and phone bills.

Pick the celebrations that matter most. Carpool, share Airbnb costs, or attend just part of an event to cut expenses.

Autopay your bills and automate your savings. The less you rely on willpower, the easier it is to stay on track.

Many Chicagoland buyers still think they need 20% down. The reality: FHA, VA, and other loan programs can get you in with as little as 0–3%. Some local Chicago first-time buyer programs can also help.

Buying a home in Chicagoland is one of the most rewarding milestones you can hit—but it doesn’t happen by accident. With the right plan, these Chicago homebuyer tips can help you enjoy life’s big moments and stay on track to own your dream home in the Chicago area.